Every day people spend a whopping 13 billion US dollars worldwide on online shopping. Generally, it creates a huge market of e-commerce sales estimated at roughly 5 trillion USD per year. And that figure only mounts up. Namely, fintech trends and innovative technologies make this revolution happen. And that’s just the beginning!

A Story of a Fintech Startup Path From $0 to $95+ Billion in a Decade

Back in 2010, online shopping was already on the rise. However, the single hardest thing in setting up an online business was hidden under the payments integration. It was really difficult to accept fees on the web. The two Collison brothers started thinking about how to deal with the issue globally. They believed that it all could function a lot easier.

The initial idea was to focus on a technology solution for app developers who can merely integrate it into the e-commerce website or web app instantly. After that, the online retailer could simply accept and pay money. Within just two weeks the brothers have spent on creating an MVP, then performed their first transaction, and within a few years have built a fintech services ecosystem. That’s how Stripe was founded.

Read also: How to Create An Investment Software Like Robinhood

Check out how much does it cost to develop a popular investtech app

The developers’ community has appreciated the efforts in building a fintech product for them. There was almost no competition in the online payments niche. Paypal was the biggest competitor, however, it was more focused on building a product for consumers, rather than developers. Integrating payment API for business use cases into apps, websites, and marketplaces at scale was the winning decision of the Collison brothers.

With a focus on developers, Stripe has substituted a lengthy enterprise sales cycle with a fast customer adoption. Amazon, Uber, Shopify, Postmates – all of these giants use Stripe to process payments. Actually, there’s a good chance you have already made a purchase via Stripe, even if you are not aware of it.

Success for the two young startup founders is far from a godsent. The secret souse is in a blend of vision, business acumen, and a little charisma. It all helped them to raise millions of dollars in seeds funding. Within just 4 years Stripe’s valuation rises above billions. And after a decade, the fintech company is evaluated at US $95 billion.

So, How on Earth Did They Do It?

Let’s see their route to success step-by-step. And possibly replicate it…

Step #1. Solve a Real Problem

While every side of starting an online business became simpler, payments processing has been far from an easy task. That’s how the Stripe idea was born.

With a focus on developers, instant setup opportunities, and flexible scalability, it has won the hearts of even the biggest tech companies like Facebook, Microsoft, Google, and so on.

Step #2. Focus on User Experience

They have been obsessed with customer satisfaction. The fintech product should be easy to use – just copypaste several lines of code and go ahead to enjoy smooth payments processing.

The tech documentation was clear as day which allowed e-commerce brands to integrate payment systems within a couple of hours.

Step #3. Evolve Continuously

Even if you are a trailblazer and a leading fintech company, the competition never sleeps. So to keep the top positions in the market, you should always continue innovating.

Stripe strengthens its leadership by special price offers, a worldwide presence, and custom software solutions built for specific business areas.

These are three simple steps that helped Stripe grow into a huge fintech ecosystem with Forbes 50 enterprises among its clients. Amazing, isn’t it?

So why not replicate this kind of success in the fintech arena? Especially since the market continues to grow and is in such a burning demand for fintech apps able to revitalize the financial sector.

Let’s see where the fintech software potential lies and how you can hit the gold mine!

FinTech Market Overview

Adoption and investment in the global fintech niche have literally exploded over the past years.

Actually, there are a lot of arguments to make in order to realize how beneficial it may be to use a fintech business model. When it comes to business, numbers are always among the top priorities.

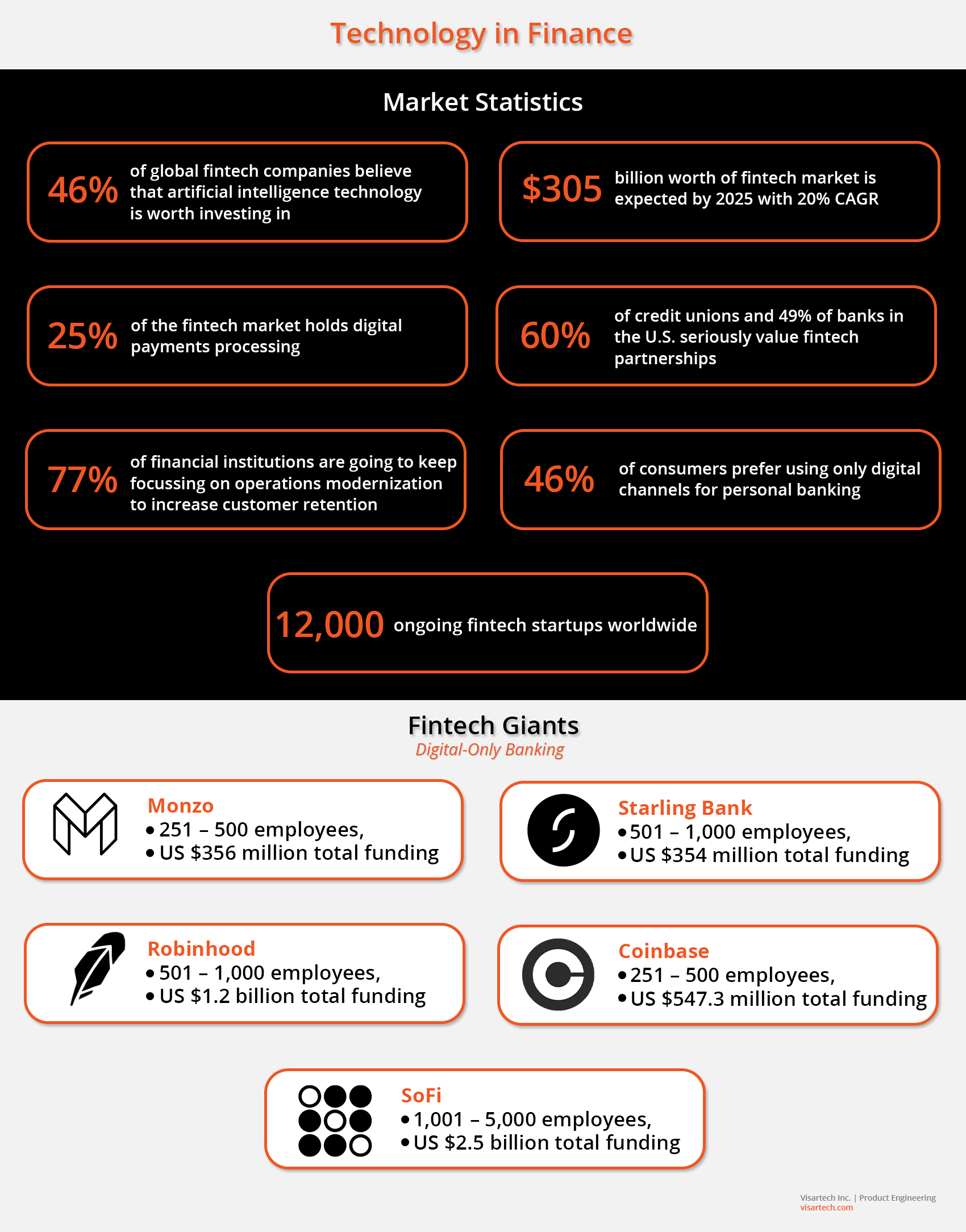

- The global fintech market is expected to grow at nearly 20% each year and its value should reach the US $882.3 billion by 2030 (GlobeNewswire).

- 60% of credit unions and 49% of banks in the U.S. seriously value fintech partnerships (FinancesOnline).

- 25% of the fintech market holds digital payments processing (McKinsey).

- There are around 26,000 ongoing fintech startups worldwide.

- 46% of global fintech companies believe that artificial intelligence technology is worth investing in.

- 77% of financial institutions are going to keep focussing on operations modernization to increase customer retention (PWC).

- 46% of consumers prefer using only digital channels for personal banking (Singularity University).

- 93% of worldwide companies utilize at least one cloud-based service. (Spice Works)

All these data point to one major fact – technologies are already changing the financial sector and the speed of their adoption is only growing.

Let’s just think about the way modern society manages personal finances. Nowadays consumers increasingly turn to digital-only banks that form a sort of a threat to traditional banking institutions.

Let’s name a few of such fintech giants:

- Monzo: 1000 – 5000 employees, US $1.18 billion total funding

- Starling Bank: 1000 – 5000 employees, US $1.06 billion total funding

- Robinhood: 1000 – 5000 employees, US $5.37 billion total funding

- Coinbase: 1000 – 5000 employees, US $547.3 million total funding

- SoFi: 1000 – 5000 employees, US $3 billion total funding

Seems like the digital banking market is booming. It might be interesting for those looking to invest the capital into some serious and promising venture.

Key Fintech Software Types

Actually, there are many business models available in the fintech arena.

Mostly, they have affected the following fields:

- Banking

- Insurance

- Lending

- Personal finance

- Electronic payments

- Venture capital

- Wealth management

Let’s see what fintech software you can develop for these financial categories.

Online Banking Software

Digital banking allows consumers to perform transactions online fast and easily, manage accounts, view transaction history, and do many other financial things.

Digital banking software utilizes such technologies as AI, chatbots, and face and voice biometrics.

Benefits of online banking software:

- 24/7 operating period.

- Increased customers satisfaction due to fast transactions processing.

- Reduced time to market compared to a traditional banking institution.

- Extended customer audience due to bigger accessibility from mobile and desktop devices.

- Easier rebranding.

Key features of online banking software:

- Remittances provide cross-currency funds transfers.

- Chat allows to securely exchange documents and private information.

- Notifications provide users with real-time updates about their banking activities.

- Reports give all data about user spending and income divided into groups by various factors.

Insurance CRM Software

Such insurance software gives insurers the necessary information about customers and the ability to perform the usual activities of insurance operations management. It includes creating reports, generating documents, and tracking work efficiency.

InsurTech companies use IoT, mobility software, data science, etc. All these technologies allow insurance agents to increase customer satisfaction through personalized offers, control risks and raise revenue.

Benefits of insurance CRM software:

- Time and cost-efficiency due to operations automatization.

- Boost operational effectiveness when agents are focused on sales rather than paperwork.

- Tighter interactions with customers via digital marketing tools.

Key features of insurance CRM software:

- Task management automates staff management.

- Document generation fills the predefined information automatically.

- Commission tracking provides data about employees’ efficiency.

Loan Management Software

People no longer need to contact banks or credit unions when seeking a loan. Financial technology companies provide lending services in a much more flexible way.

Benefits of loan management software:

- Better performance due to no repeated data entry.

- Improved sales with detailed data about each client.

- Wider cross-selling opportunities.

Key features of loan management software:

- Risk management helps lending companies to evaluate clients before the deal.

- Collections and provisioning help to monitor the situation with delinquent accounts.

Read also: Loan Management Software Development Case Study

Check out Visartech has managed to create a unique loantech app

Payment Processing Software

Such financial software simplifies payment processing both for companies and individuals. It makes the experience of payment processing much more convenient.

Benefits of payment processing software:

- Boosted efficiency due to operations automation.

- Less staff is necessary for performing the same operations.

- More clients can be attracted due to better customer experience.

Key features of payment processing software:

- Account management gives personal accounts to users with the ability to control the payment flow.

- Instant payments reduce the need to repeatedly enter users’ payment data.

- Dispute management helps to conduct chargebacks if necessary.

- Fraud protection makes sure the user’s money is secured from suspicious actions.

- Analytics helps to control the payment processing activity.

Personal Finance Software

Such fintech solutions allow people to track their financial spending and develop a personal savings plan.

Benefits of personal finance software:

- Wider customer base due to better user experience.

- Boosted efficiency due to automated operations.

- 24/7 functioning.

- Faster time to market compared to traditional personal bank accounts.

Key features of personal finance software:

- Automatic payments processing via online banking.

- Reminders point out the recurring transactions.

- Reports allow users to control spending.

- Currency conversion lets users exchange currency and make international payments.

Financial Risk Management Software

The regulation and compliance management industry combined with technologies proposes the emergence of the RegTech definition.

Among RegTech software solutions, you can notice financial risk management software. It is responsible for risk-based capital budgeting. This RegTech software can detect and analyze potential risks beforehand. It helps to make the needed actions to minimize or reduce such risks.

Benefits of financial risk management software:

- Legal entities management around the world.

- Uninterrupted business proceedings.

- Platform availability at any place or moment.

- Minimized human error due to processes automation.

Key features of financial risk management software:

- Risk management gathers and analyzes data to minimize risks.

- Automated email notifications are sent upon the configured settings.

- Analytics helps to track professional metrics.

- A security system helps to protect data.

- Compliance task management allows for controlling tasks flow.

The Most Popular Technologies in Fintech Development

Looking for the right technology stack for your fintech software project? You should consider choosing the one that can become its foundation, meet the project criteria and correspond to the project’s goal. Each programming language is the best choice for a particular purpose.

Among the most popular programming languages for fintech app development, the following technologies lead the global fintech market:

- Java

- Python

- C++

- C#

- Ruby

Java is probably the most used programming language by financial institutions. However, fintech software needs definite features that Python can manage much better compared to Java or any other programming language.

Major Strategies for Fintech Data Protection

The financial sphere unlike any other requires enhanced data protection as the outcome may be reflected in the money loss. This is like a magnet for cybercriminals.

However, despite the growing number of cyberattacks globally, any company can perform actions to minimize cyber threats. A proactive rather than reactive approach to security eliminates the risks for both the financial company and its customers.

Fintech Security Challenges

The fintech industry holds so huge amounts of sensitive information like bank accounts, passwords, and personal data.

First, let’s consider the existing security challenges in the fintech industry.

- Data ownership

It is important to control the rights delegated to particular people.

- Compliance with security protocols

Fintech companies should strictly follow the regulations and norms of the country where they operate. Otherwise, it may lead to bad consequences.

- Management of third-party components

To provide extended opportunities for customers and not fail with security flows, financial institutions should strictly control each third-party API.

How to Protect Data in Fintech

No worries, any risk can be mitigated by the proper preparation. Let’s check the modern approaches to deal with the above-mentioned challenges.

- Encrypt sensitive data

Data encryption allows encoding data through complex mathematical algorithms. Only specific keys can decode this data.

- Create secure code and architecture

The quality of your application’s architecture and code can not be underestimated. Buggy or messy code is easy to hack. The best way to prevent such flows is to conduct code reviews. Additionally, you can make use of the technology consulting services from a chosen vendor.

- Secure authentication

Most cyber-attacks are conducted via lost or compromised authentication data. Secure and precise identification and authentication are vital for fintech software. There are many techniques developed to secure this data like two-step authentication or SMS verification, etc.

- Code obfuscation

Code obfuscation is an effective way to trick hackers and protect fintech software from cloning.

Best Fintech Companies Revolutionizing The Industry

There are thousands of companies already implementing technologies in the financial sector.

Here is a list of top fintech companies transforming the fintech space.

#1. Fastacash

This global payments platform operates in terms of always providing value. Users can easily transfer various items via secure links over any social media or messengers. They can send cash, airtime, coupons, pictures, etc.

What’s more important is that everything is conducted within a single platform. It is a brilliant example of how a simple idea can impact society.

#2. Starling

This trendsetting online banking helps users to plan their finances. Simple charts and graphs make the process easy. It is created with a thought about its client.

It sometimes happens that when you lose a card, you need to freeze it. But once you find it, it is a big issue. This fintech solution allows you to turn on and off the card when you need it with a simple touch.

The fintech software provider doesn’t have physical branches, however, it is easily accessible through a global bank.

#3. Square

The fintech startup pushes Point of Sale (POS) systems much further than they are now. It provides free POS software and inexpensive hardware. It is reflected in tiny white squares connected to tablets and mobile devices.

This way small businesses like farmers’ markets or any other tiny stores move to this fintech software. It brings more security to financial operations. Enabling more users to utilize their services, the company is already evaluated at US $6 billion.

#4. Affirm

Affirm is a fintech company that provides installment loans to consumers. They cooperate with such giant retailers as Walmart and e-commerce companies as Shopify. This fact hugely influences the wide customers base. Which in turn reflects in a big revenue of around US $600 million.

#5. Circle

This fintech project acts as a peer-peer mobile payment platform. It is still a private company that has raised US $135 million in investments. At some point, the fintech company has created an Ethereum coin backed by the USD.

This fintech mobile platform allows exchanging currencies in real-time. It is a distinctive advantage of this company among its competitors.

The Key Ingredients For Success

There are many more top players in the fintech industry who were not afraid of conquering the challenges. Here are some things we can learn from them:

- Search for a market opportunity.

- Offer cost benefits for your consumers.

- Create convenience for users.

- Aim at future growth.

These are the benchmarks of top fintech software companies’ success. Now let’s move on to the trends that you can follow in order to be among the top fintech industry players yourself.

Top 5 FinTech Trends to Watch in 2023

Fintech developments undergo fast so those entrepreneurs, who wish to follow the innovations, will want to keep up. Here are the top trends that will change financial services in the upcoming year.

#1. Wealth Management

Big technology companies like Amazon, Microsoft, and Google are already creating the digital infrastructure necessary for wealth management proceedings. Almost 75% of global top entrepreneurs claim they would use these services from the big giants.

#2. Robo-Advisor Adoption

The financial advisory services with the artificial intelligence touch have become really popular. It is expected to grow even more – to US $830 billion by 2024.

#3. Regulation Technology

There are still too many operations performed manually. It is expected that regulation technology systems will be adopted in a much bigger volume. It is beneficial in both streamlining processes and saving costs.

Read also: How to Save Money on a Web Project for Businesses

Learn how to select the best tech stack for your web application

#4. Co-Development And Joint Ventures

Fintech software solutions continue replacing the outdated legacy systems on the market. Co-development and joint ventures are expected to appear in places filled with inefficiencies. Fintech software can reduce the sales costs in the back office of traditional financial institutions.

#5. Non-Fintech Players

Even non-tech companies are looking for new ways to monetize their services and grow their customer base. Other fintech software companies continue expanding their services and enter other fintech niches like loantech, trading, insurtech, etc.

Conclusions

The bottom line? Fintech trends are officially a major direction that will transform financial services for good. It is a serious player in the global economy that is rapidly growing and, for sure, here to stay.

Looking at the prospects fintech software can provide and the already functioning top fintech companies, there is a place for deep thought here. What can you learn from their strategies? The most obvious answer is to add competitive value to your fintech product. That is exactly what made them successful in the first place.

However, you can find your own competitive edge – as the market is booming, there is always a certain spot for creativity.

Even if you are not representing the financial industry. As the latest trends state, there is room for everyone willing to monetize their businesses.

Just make a step into the world of fintech solutions with professional help in hand!